Ever picked up your prescription and been shocked that your generic drug cost more than the brand-name version? You’re not alone. It’s happened to millions of people across the UK and the US, and it’s not a mistake. It’s by design.

Most health plans today use something called a tiered copay system to decide how much you pay for your medications. At first glance, it seems fair: lower tiers for cheaper drugs, higher tiers for expensive ones. But here’s the twist - not all generics are created equal in the eyes of your insurer. Some generics, even though they’re chemically identical to others, sit in higher tiers with much steeper copays. And the reason? It has nothing to do with how well the drug works. It’s all about money - and who’s negotiating it.

How Tiered Copays Work

Think of your drug plan like a grocery store with different pricing sections. Tier 1 is the clearance rack - generics with the lowest copay, often $0 to $15 for a 30-day supply. Tier 2 is the regular shelf - preferred brand-name drugs, usually $25 to $50. Tier 3 is the premium section - non-preferred brands, $60 to $100. Tiers 4 and 5? Those are for specialty drugs - things like biologics for rheumatoid arthritis or cancer treatments - where you might pay 20% to 40% of the total cost.

But here’s where it gets confusing: not every generic drug lands in Tier 1. About 12% to 18% of generic medications are placed in Tiers 4 or 5 because they’re used for rare conditions, require special handling, or cost over $600 a month. Even worse - some insurers have a second generic tier. Tier 1: preferred generic. Tier 2: non-preferred generic. Same active ingredient. Same FDA approval. Same effect. But one costs $15. The other? $30.

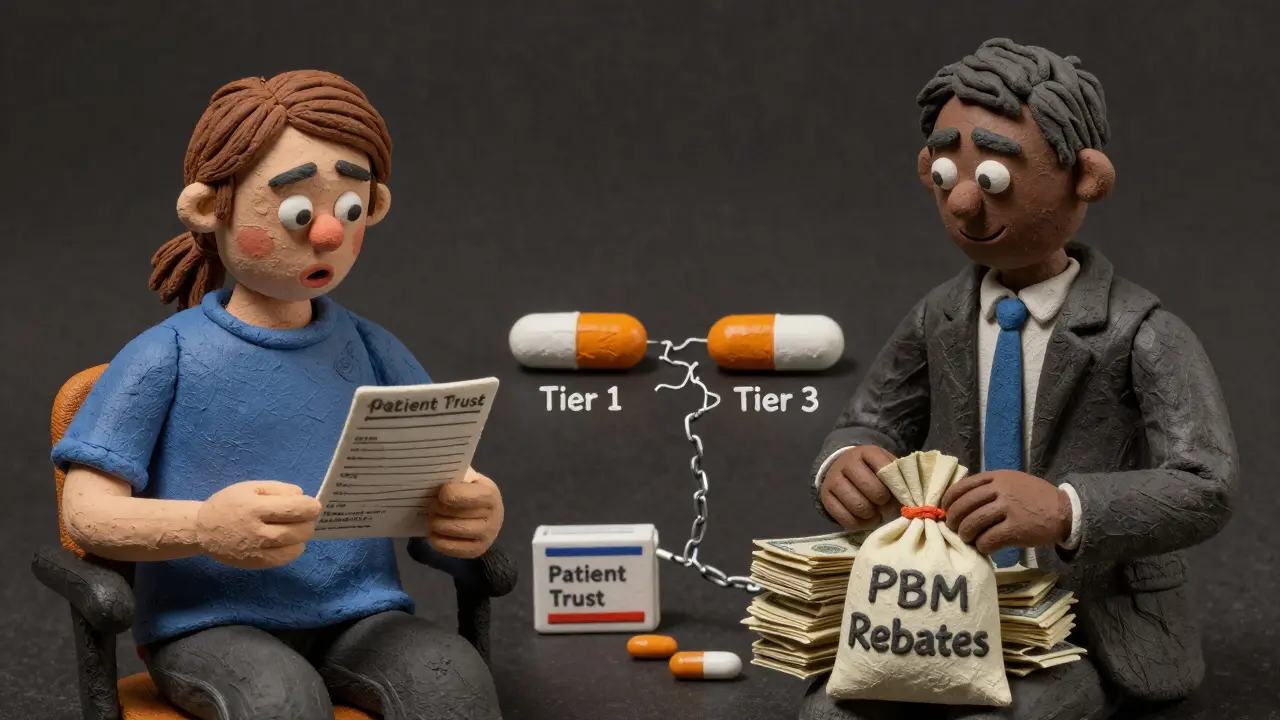

This isn’t an accident. It’s a financial lever. Pharmacy Benefit Managers (PBMs) - the middlemen between drugmakers, insurers, and pharmacies - negotiate rebates with manufacturers. The company that gives the biggest discount gets its generic drug placed in Tier 1. The others? They get stuck in Tier 2 or higher. Your doctor might prescribe levothyroxine. Your pharmacy might fill it with a generic. But if that generic isn’t the one your insurer negotiated with, you’ll pay double.

Why Your Generic Costs More Than the Brand

Let’s say you take a generic blood pressure pill. The brand version costs $80. The generic? $12. Sounds great. But then, suddenly, your copay jumps to $45. Why? Because the manufacturer of your current generic didn’t renew its rebate deal with your PBM. So the insurer moved it to Tier 3. Now, they’re pushing you toward a different generic - same drug, same company, same effect - but one that gave them a better discount.

This isn’t rare. In 2024 alone, Express Scripts moved 87 generic drugs to higher tiers because their rebate deals expired. UnitedHealthcare shifted dozens of high-volume generics like atorvastatin and lisinopril to $0 copays - but only the ones they had the best deal on. Others? They got bumped up.

Patients don’t see this coming. A 2023 survey found that 41% of insured adults had a generic drug suddenly cost more than expected. And 68% said their insurer gave them no clear explanation. You might get a letter saying “formulary change” - but no details. No warning. No choice.

Even worse - pharmacists are often required to switch your medication automatically. If your prescription says “levothyroxine,” and your plan prefers one brand over another, the pharmacist can swap it without asking. You might not even know until you get the bill.

The Real Reason: Rebates, Not Results

There’s a myth that Tier 1 generics are “better” or “more effective.” They’re not. A 2022 study in Health Affairs made it clear: “Preferred status has nothing to do with clinical superiority - it’s entirely about the rebates.”

Imagine two identical generic versions of metformin. One is made by Company A. The other by Company B. Both work the same. Both are FDA-approved. But Company A gave the PBM a $2 rebate per pill. Company B gave $0.50. So Company A’s version gets Tier 1. Company B’s? Tier 2. You pay $30 more per month - not because it’s less safe, but because Company B didn’t pay enough.

Dr. Aaron Kesselheim from Harvard put it bluntly: “Tiering generics differently undermines the fundamental purpose of generic substitution and creates unnecessary financial barriers.”

And it’s getting worse. As specialty drugs - like biosimilars for autoimmune diseases - become more common, insurers are starting to tier those too. You might be on a generic version of adalimumab (Humira). But if your plan has three different biosimilar generics, only one will be in Tier 1. The others? You’ll pay 30% coinsurance - even though they’re all the same drug.

What You Can Do

You can’t control the rebates. But you can control what you do next.

- Check your formulary - every year, usually in October, your plan releases a new drug list. Look up your medication. Is it still in Tier 1?

- Ask your pharmacist - “Is this the preferred generic?” If not, ask if they can switch it. Most will.

- Use GoodRx or SmithRx - these tools compare prices across pharmacies and tiers. Sometimes paying cash is cheaper than your copay.

- Request a therapeutic interchange - if your doctor writes a note saying your current generic works fine, your insurer may approve the switch - and it works 63% of the time.

- Ask about manufacturer assistance - many drugmakers offer coupons or free programs. In 2023, 22% of specialty drug users got help this way.

Don’t assume your prescription is fixed. If your copay jumped, it’s not you. It’s the system. And it’s changing all the time.

The Bigger Picture

Tiered copays were created to save money - and they did. Studies show they cut overall drug spending by 8% to 12%. But the cost isn’t just financial. It’s emotional. Patients skip doses. They delay refills. They stop taking meds because they can’t afford the new copay.

A 2005 study found that when diabetes drugs moved from Tier 2 to Tier 3, adherence dropped by 7.3%. That’s not a number - that’s people getting sicker.

By 2025, Medicare will cap out-of-pocket drug costs at $2,000 a year. That’s a win. But it won’t change the tier system. You’ll still be paying more for the same drug just because the rebate expired.

The truth? The system isn’t broken. It’s working exactly as designed - to save money for insurers and PBMs, not to make things simple for you. And until that changes, you’ll keep getting bills you don’t understand - for pills that should cost less.

Why is my generic drug suddenly more expensive?

Your generic drug likely moved to a higher tier because the manufacturer stopped offering a rebate to your Pharmacy Benefit Manager (PBM). Even though the drug is chemically identical, the PBM only puts the version with the best discount in the lowest tier. This is a business decision, not a medical one.

Can my pharmacist switch my generic without telling me?

Yes. Many insurance plans require pharmacists to substitute a preferred generic if it’s available. This is called an automatic therapeutic interchange. You may not know until you see the higher copay on your receipt. Always ask if the medication you received is the one your doctor prescribed.

Are all generics the same?

Yes - legally and medically. The FDA requires generic drugs to have the same active ingredient, strength, dosage form, and route of administration as the brand. They must also meet the same quality standards. Differences in inactive ingredients (like fillers) rarely affect how well the drug works.

How do I find out which tier my drug is on?

Log into your insurer’s website and look for your plan’s formulary - a list of covered drugs and their tiers. This is updated yearly, usually in October. You can also call your insurer or ask your pharmacist. Tools like GoodRx and SmithRx also show tier information and cash prices.

What if my drug moved to a higher tier and I can’t afford it?

Request a therapeutic interchange form from your doctor. If they write a note saying the current generic works for you, your insurer must review it - and approves it 63% of the time. You can also ask about manufacturer coupons or patient assistance programs. Sometimes paying cash at a discount pharmacy is cheaper than your copay.

Will the new $2,000 Medicare cap change this?

No. The $2,000 out-of-pocket cap limits how much you pay in a year, but it doesn’t change how drugs are tiered. Your generic could still be in Tier 3, and you’ll pay more per prescription - you’ll just stop paying once you hit the cap. The tier system itself remains intact.